Reverse charge is a procedure moving the responsibility for the reporting of a VAT transaction from the seller to the buyer.

On the POS workstation, the Reverse charge parameter is available in the following places:

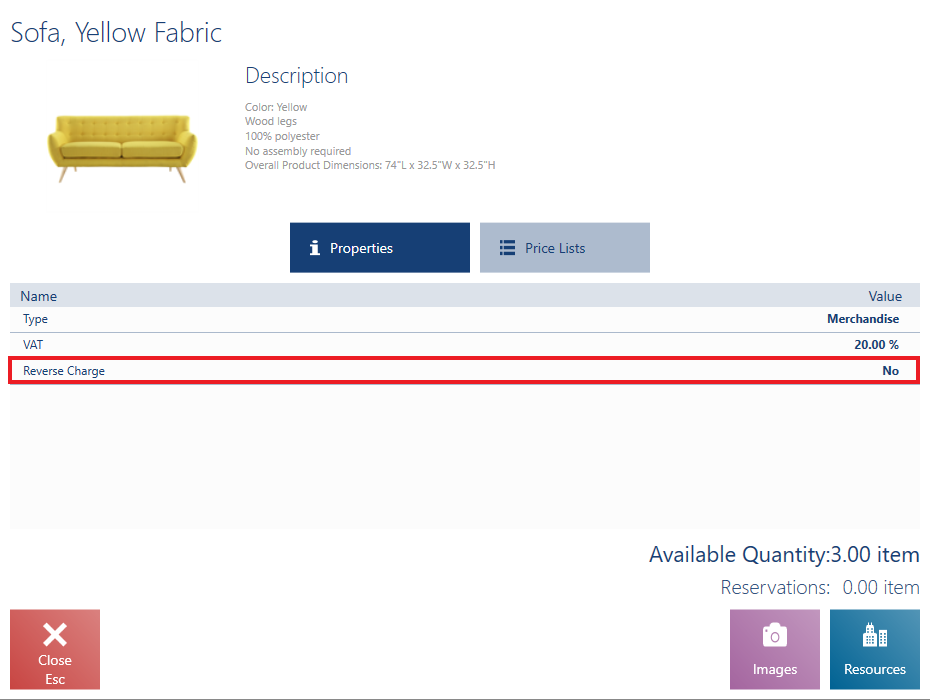

- Item form – the parameter cannot be edited there. Its setting is transferred from the ERP system.

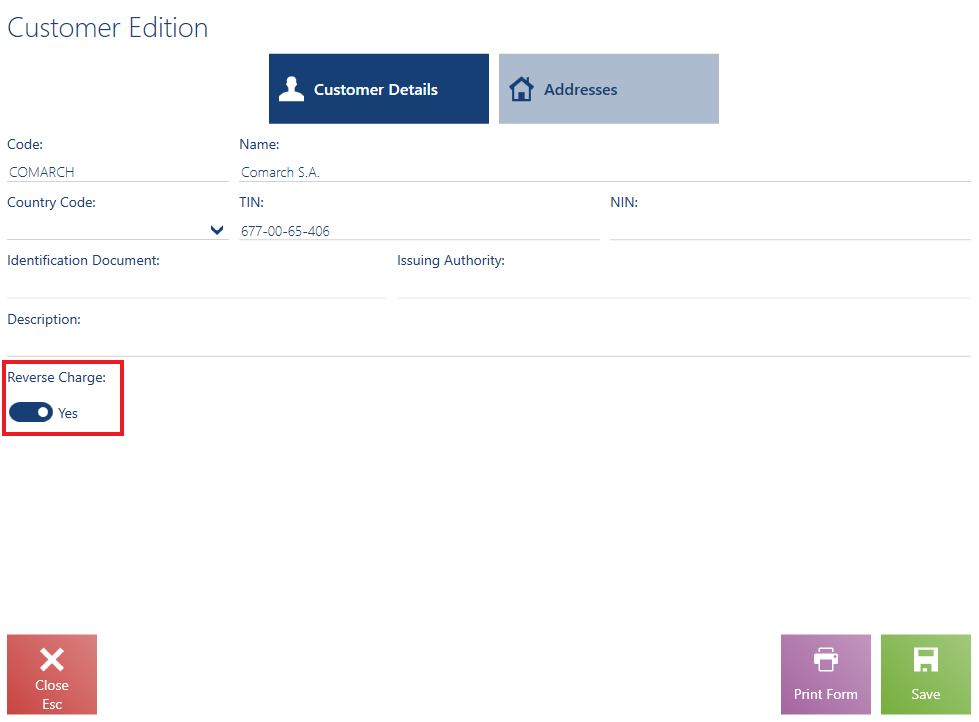

- Customer form – the parameter can be edited for customers of the Domestic type

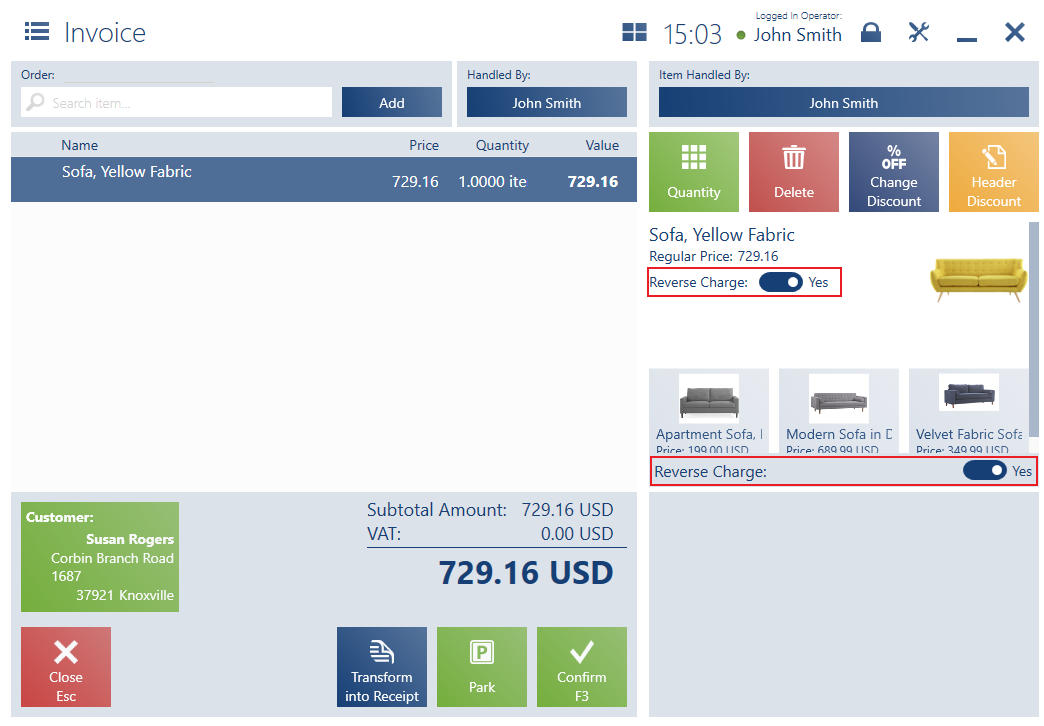

- Document form (SQ, SO, ASI, SI, ASIQC, SIQC) – the parameter can only be edited for unconfirmed documents or open sales orders related to national transactions. The parameter’s setting is transferred from the customer form.

- Document item – the parameter can only be edited if the Reverse charge parameter of the document being issued is selected. The default value of the document item’s parameter is transferred from the item form. Selecting the parameter for a document item automatically changes a VAT rate.

Upon the generation of:

- A receipt from a sales order in which reverse charge has been used, the application displays the blocking notification: “Cannot issue the receipt, as reverse charge has been applied in the order. Would you like to issue a sales invoice?”

- A sales order from a sales quote or a sales invoice from a sales order, the value of the Reverse charge parameter is transferred from the source document, with a possibility to edit it

- Advance invoices and SI/ASI corrections, the value of the Reverse charge parameter is transferred from the source document, with no possibility to edit it

- A sales invoice from a receipt, the Reverse charge parameter cannot be selected

In a SOR document generated in the ERP system for a sales invoice issued on the POS workstation, the value of the Reverse charge parameter is transferred from the source document, with no possibility to edit it.

After changing a customer in a document, regardless of the user’s answer to the question “Do you want to recalculate the document according to customer settings?”, the value of the Reverse charge parameter is always updated. The update is done according to settings specified on the form of a given customer.